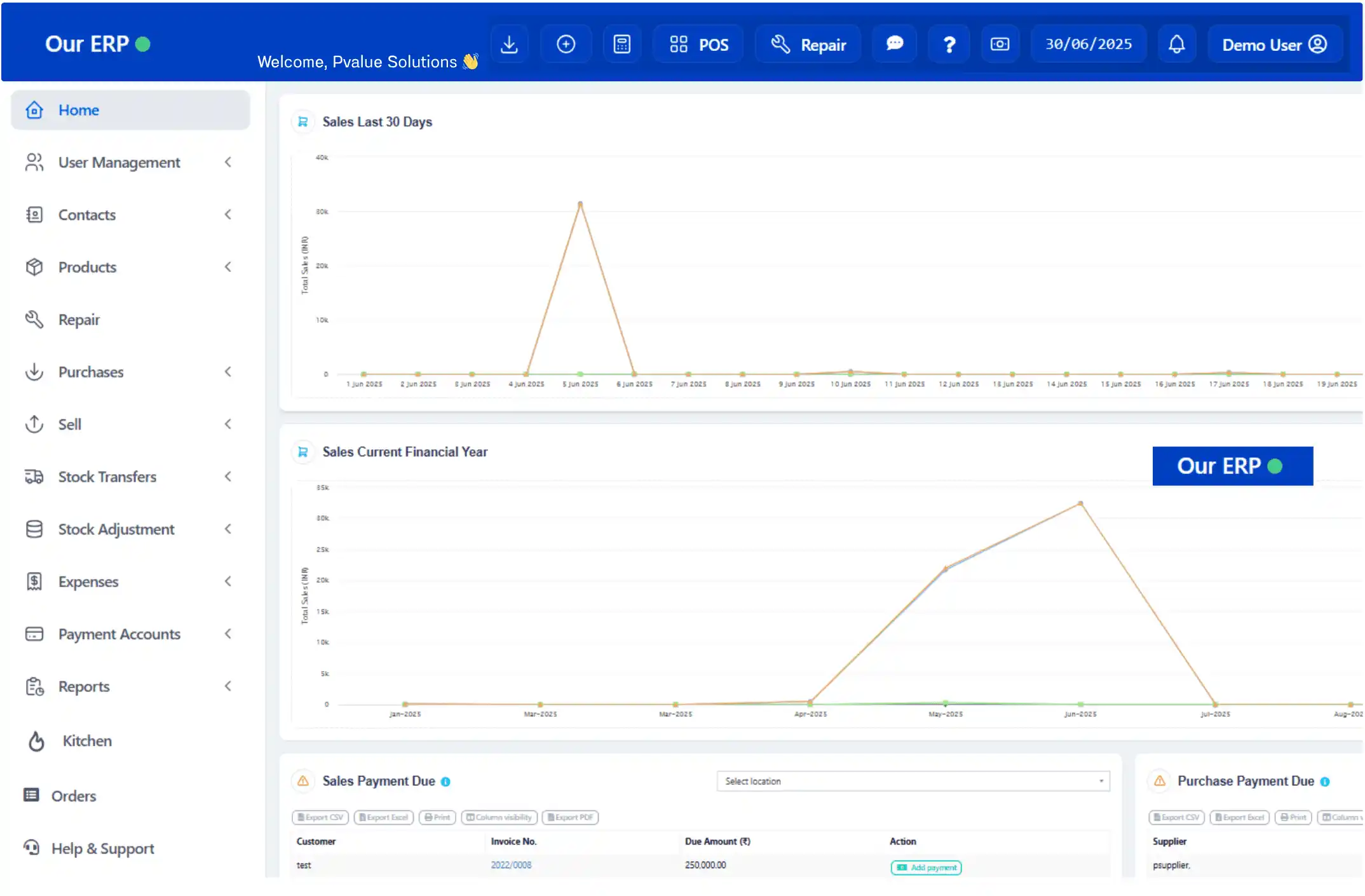

Connect Your Data

Easily upload your sales/purchase data from Tally, Excel, or other ERPs.

Reconcile & Validate

Run advanced reconciliation to match ITC and let our smart engine find errors.

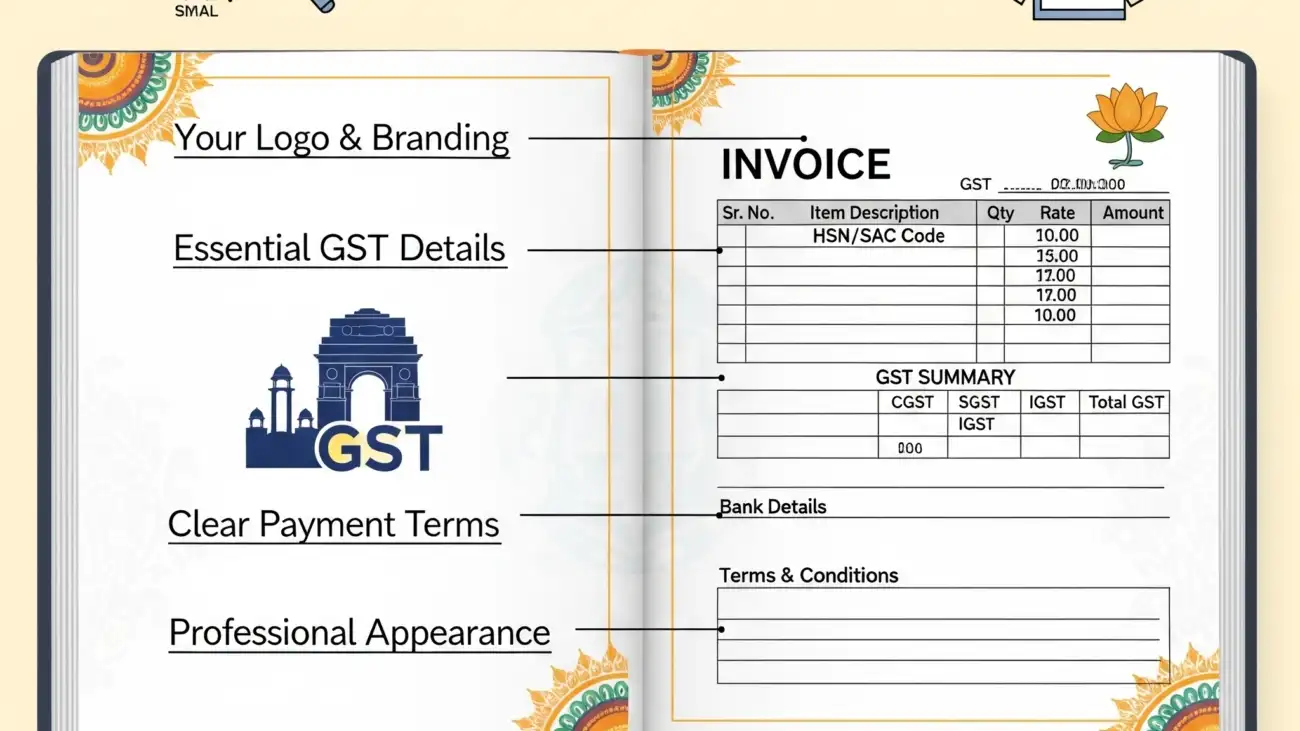

File Your Returns

File your GSTR-1 and 3B directly with the GSTN portal in a single click.